The Secret Reasons You Must Consider Insurance for Financial Safety And Security

In today's uncertain globe, insurance policy emerges as a cornerstone of economic protection, cushioning people and family members against substantial financial losses from unanticipated events. Whether it's mitigating the high costs linked with wellness emergencies or safeguarding important assets like automobiles and homes, having the ideal insurance coverage plans in position makes sure that a person's economic wellness remains undamaged. This safety web not only maintains way of life and wellness however additionally safeguards a family's future stability (abilene tx insurance agency). The breadth of protection and the selection of plans vary widely, raising the inquiry: what exactly should one look for to fully harness the benefits of insurance policy?

Mitigating Financial Risks From Unanticipated Events

Alleviating financial risks from unexpected occasions is essential for maintaining security in one's monetary life. Insurance coverage serves as a vital device in this procedure, offering a safeguard that assists families and individuals handle economic uncertainties. The essential purpose of insurance is to transfer the financial concern of life's changabilities to an insurance company for premiums. This shift in financial obligation guarantees that when disasters like mishaps, natural tragedies, or burglary happen, the insured celebration is not bewildered by possibly ruining monetary costs.

Furthermore, the visibility of insurance can offer satisfaction, allowing people to involve in day-to-day activities and long-lasting investments without the constant anxiety of economic spoil. It additionally promotes a complacency that supports financial security and growth by encouraging costs and financial investment in various industries. As a result, insurance not only protects individuals but also contributes to the broader financial structure.

Enhancing Health and Wellbeing With Adequate Protection

Adequate health insurance protection is vital in boosting an individual's health and wellness. Health and wellness insurance policy strategies typically consist of preventive treatment services, such as vaccinations and normal check-ups, which are vital in keeping great health and wellness and preventing illness.

Protecting Possessions and Investments

Insurance policy serves as an important guard for guarding possessions and investments versus unexpected economic setbacks. By transferring the danger of possible monetary losses to an insurance supplier, people and companies can safeguard their economic sources from different threats such as all-natural disasters, theft, or residential property damages. Home insurance makes certain that in the occasion of a fire or flooding, the monetary worry of repairing or replacing the damaged residential or commercial property does not destabilize the owner's monetary problem.

Additionally, investment insurance coverage, like title insurance in real estate, shields versus losses from issues in title to a building. Insurance coverage additionally covers obligations that may emerge from claims or third-party problems, thereby protecting an investor's wider economic portfolio from prospective legal complexities.

Guaranteeing Family Stability and Future Security

Verdict

In verdict, insurance coverage is essential for monetary security, effectively minimizing dangers from unexpected events and enhancing total well-being. It offers as a safety obstacle for investments and assets, while guaranteeing the security and future safety of households. By cultivating monetary resilience and offering comfort, insurance policy supports not only private and familial security however likewise contributes extensively to financial stability, making it a vital component in economic planning and threat administration techniques.

Whether it's minimizing the high costs linked with health emergencies or securing valuable assets like homes and cars, having the right insurance policy plans in area ensures that one's financial health stays intact. By moving the risk of potential monetary losses to an insurance provider, organizations and people can shield their monetary resources from various risks such as natural disasters, theft, or property damage. Residential or commercial property insurance ensures that in the occasion of a fire or flooding, the economic burden of fixing or replacing the damaged residential or commercial property does not destabilize the owner's monetary problem.

In addition, financial investment insurance policy, like title insurance in genuine estate, safeguards versus losses from flaws in title to a residential or commercial property. By fostering economic strength and providing peace of mind, insurance coverage sustains not just specific and familial stability however additionally contributes broadly to economic stability, making it a critical element in monetary preparation and danger administration methods.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Bradley Pierce Then & Now!

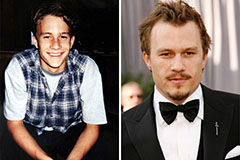

Bradley Pierce Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!